Are REITs Redefining Land Banking as a Better, More Liquid Way to Store Value and Speculate Real Estate Growth?

In Kenya’s real estate market, the saying “buy land, they’re not making any more of it” has been gospel for generations. Investors have long built wealth by acquiring parcels on the outskirts of Nairobi, Kisumu, or Mombasa, waiting for urban expansion to work its magic.

But while traditional land banking has created immense value for some, it has also become capital-intensive, illiquid and increasingly inefficient in today’s fast-changing, data-driven investment landscape.

Let’s talk liquidity, for instance. Many investors find themselves holding land they cannot easily sell, unable to convert their “paper gains” into real returns. A recent trend has been to leverage this land as collateral for financing, which works well for a few and often fails for most. It’s a sign that it’s time we rethink how we invest in real estate and to move away from the old practice of buying assets in the middle of nowhere purely for speculation.

Enter Real Estate Investment Trusts.

A Real Estate Investment Trust is an Investment vehicle that is designed to allow investors to pool capital to invest in real estate assets. It enables the aggregation of properties into one investment vehicle which investors hold through tradable units. Investors buy 'units’ in the REIT and they earn returns in the form of rental income & potential capital gains

The Acorn I-REIT Example - Land-Like Growth, Simplified

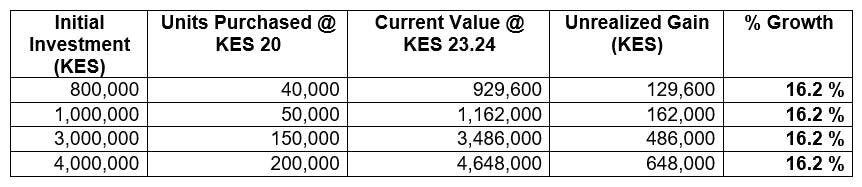

The performance of the Acorn I-REIT, Kenya’s leading income-generating REIT, perfectly illustrates this new approach. Since inception, its unit price has risen from KES 20.00 to KES 23.24 by mid-2025, a 16.2 % increase.

This steady appreciation mirrors the natural rise in land value, except it comes without the high entry costs, management stress, land rates or the risk of speculative stagnation.

The Case for the Acorn I- REIT Returns - What Your Investment Would Look Like Today

If you had invested in the I-REIT at inception when units were priced at KES 20.00, your investment today (at KES 23.24) would have appreciated as follows:

💡 Note: This does not include dividends, which would further enhance total returns, turning the I-REIT into a hybrid of land appreciation and income generation.

What Is Land Banking with REITs?

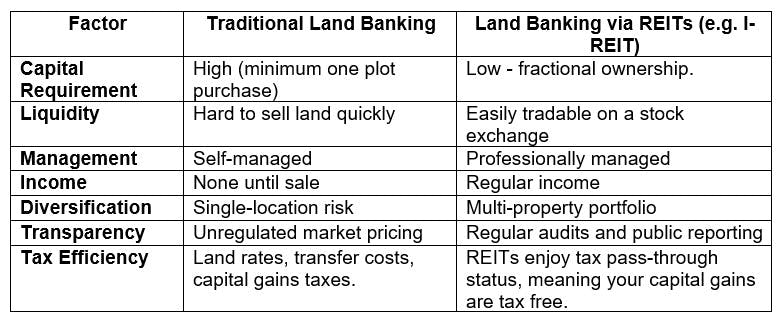

Traditional land banking involves buying and holding undeveloped plots in anticipation of future growth. The concept of land banking through REITs applies the same principle but replaces speculation with data-backed, income-producing and diversified real estate holdings.

In a REIT, investors benefit from professional portfolio management, access to high-value properties and regulatory protection under the Capital Markets Authority (CMA). The REIT essentially does the “land banking” for you, while you enjoy the returns.

Why Land Banking via REITs Beats Buying Actual Land

The result? Investors gain land-like appreciation, without tying up large sums or dealing with administrative headaches. This means, you don’t just speculate but you earn an income even as you speculate.

From Speculation to Strategy: The New Land Banking

Land speculation used to be about patience and intuition; now, it’s about strategy, structure and scalability. REITs bridge that evolution, turning speculative land banking into a measurable, tradeable and diversified investment model.

For investors seeking long-term exposure to Kenya’s real estate boom, land banking through REITs offers the best of both worlds:

· Capital appreciation similar to land,

· Steady passive income,

· Liquidity through NSE trading, and

· Professional, transparent management.

The I-REIT’s performance isn’t just a financial chart, it’s a glimpse into the future of real estate investing in Kenya.

To learn more about REITs, read this article: Is Investing in REITs in Kenya Profitable?